Last month, my bank sent me a snail mail letter alerting me to “Important changes” coming to my business account. The brochure got closer to the point:

Last month, my bank sent me a snail mail letter alerting me to “Important changes” coming to my business account. The brochure got closer to the point:

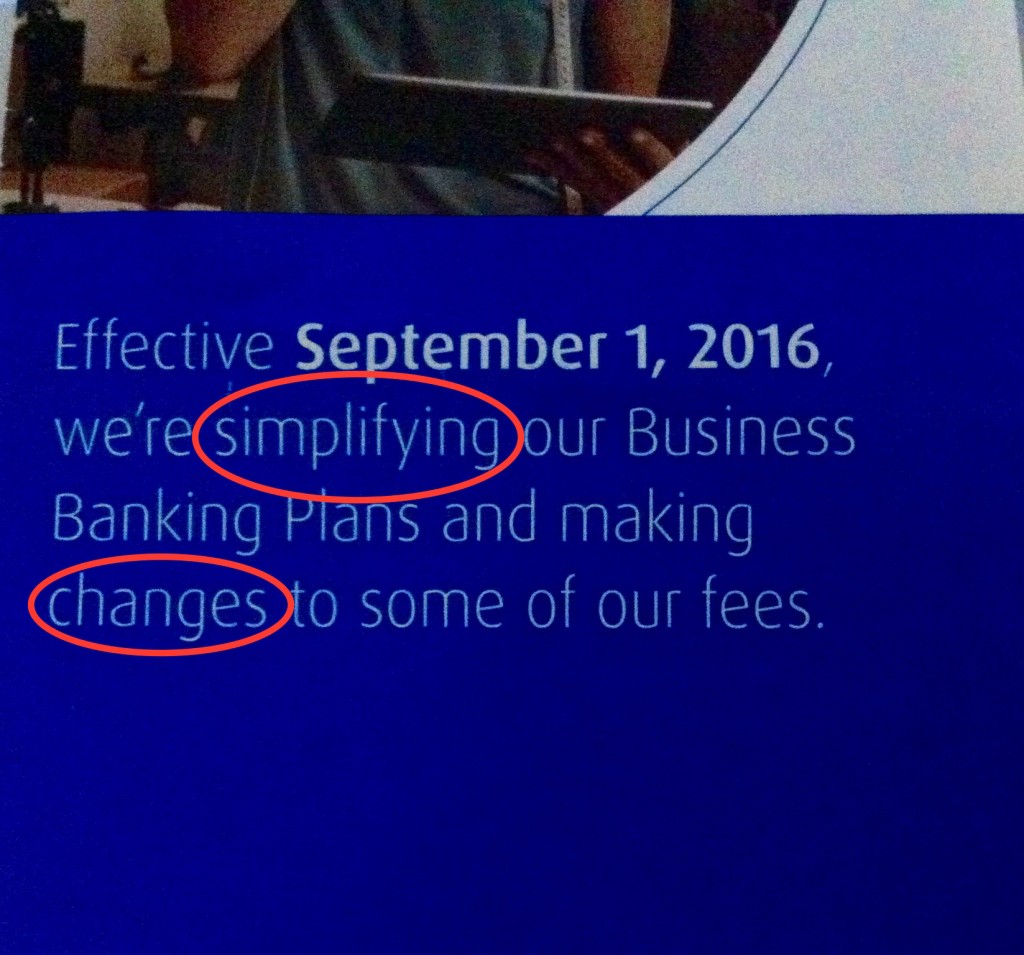

“Effective September 1, 2016, we’re simplifying our Business Banking Plans and making changes to some of our fees” (emphasis mine).

I don’t know about you, but when someone alerts you to “changes” to your fees, don’t you find that’s usually jargon for “increases” to your fees?

That was indeed the case here. Although the brochure enthused that “simplifying” my existing plan would mean I could “benefit from more features” that can help save time and money, the simplified plan actually meant more than doubling the monthly fee, with limited extra value. It also meant that I could no longer have the fee waived by keeping a certain balance during a month.

So the other day I stopped by the bank to express my displeasure to someone in person and switch to an even more “simplified” plan with fewer transactions included. I found out that the change to a more expensive plan was happening automatically and there was no way to pre-empt it. I have to wait for the switch, then email a request to change it.

There are ways to introduce changes that save a company money. You explain why the change is necessary. You phase the change in, in stages. You get feedback. You offer options.

This is not a shining example.

Looking up the bank’s latest financial results (record-setting, apparently), I found their expressed vision is “To be the bank that defines great customer experience.” Its first “strategic priority” is to “Achieve industry-leading customer loyalty by delivering on our brand promise.”

When someone proposed this simplifying process, did anyone pass it by the vision and strategic priority to see if they matched?

Related reading

Four steps to a meaningful mission statement

“Valued subscribers” to newspapers and magazines don’t get the best treatment

Customer “service” in the car insurance business

You need to name and shame the specific bank.

Bank of Montreal.